Planning a home renovation and thinking about adding floor insulation? You might be wondering about the costs, especially with all the talk about energy efficiency. Good news! The government has made some changes to VAT on energy-saving work, and it could mean some real savings for you. Let’s chat about how the VAT on floor insulation UK rules might help you cut down expenses during your restoration project.

Key Takeaways

- The UK government offers a reduced VAT rate of 5% on certain energy-saving home improvements, including some types of floor insulation.

- To qualify for the reduced VAT, the insulation must be installed by a VAT-registered contractor, and specific materials and thicknesses often apply.

- During a larger restoration project, adding floor insulation can be a prime opportunity to benefit from the lower VAT rate on these works.

- Keeping good records, like invoices clearly showing the reduced VAT, is important for claiming the correct rate.

- While VAT relief is a great saving, it’s wise to also look into other grants or schemes that might further reduce the overall cost of your insulation project.

Understanding The VAT Reduction On Energy Efficiency Improvements

So, the government’s decided to give homeowners a bit of a break on energy-saving upgrades. Starting in 2026, many energy efficiency improvements will have a reduced VAT rate of 0%. This is a pretty big deal, especially if you’re planning some work on your home anyway. It’s not just a blanket discount, though; there are rules to follow.

Eligibility Criteria For Reduced VAT Rates

To get this 0% VAT rate, your home generally needs to be a private residence, and it has to have been unoccupied for at least two years before the work starts. This applies to both new builds and older properties. The key thing is that the work must be done by a VAT-registered installer. You can’t just buy the materials and do the work yourself and expect to claim the VAT back.

Scope Of Qualifying Energy-Saving Measures

What counts as an energy-saving measure? It’s a pretty wide net. Think things like insulation (which we’ll get to!), solar panels, draught-proofing, and energy-efficient heating systems. The idea is to encourage upgrades that lower energy consumption and, by extension, carbon emissions. It’s not just about slapping insulation in the loft; it covers a range of improvements aimed at making homes more efficient.

The Impact Of The VAT Reduction On Homeowners

For homeowners, this means a direct saving on the cost of qualifying improvements. If you were already planning to insulate your floors, for example, this reduction could make a significant difference to your overall project cost. It makes these upgrades more accessible and affordable, encouraging more people to invest in making their homes greener and cheaper to run. It’s a nice little incentive to get those jobs done that you’ve been putting off.

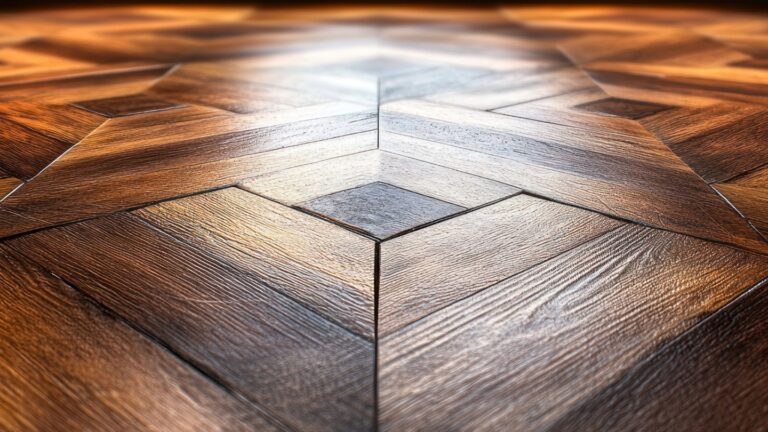

Floor Insulation As A Qualifying Energy-Saving Measure

So, you’re thinking about tackling floor insulation during your restoration project? That’s a smart move, especially with the VAT reduction in play. But does it actually count as an energy-saving measure for the 0% VAT rate? The short answer is yes, it often does, but there are a few specifics you’ll want to get right.

Specific Requirements For Floor Insulation

It’s not just any old insulation that qualifies. For your floor insulation to be eligible for the reduced VAT rate, it generally needs to be installed as part of a broader energy-saving improvement. This means you can’t just slap some insulation down in a small area and expect to get the discount. HMRC wants to see a genuine effort to improve the property’s overall energy efficiency. Think about it: the goal is to stop heat escaping from your home, and uninsulated floors are a big culprit.

Here’s a quick rundown of what they usually look for:

- Type of Insulation: It needs to be insulation material specifically designed for floors, whether that’s rigid boards, mineral wool, or spray foam.

- Installation Method: The insulation must be installed correctly. This often means it needs to be fitted into the floor structure itself, like between joists or under screed, rather than just laid on top of an existing floor.

- Purpose: The primary aim should be to reduce heat loss. If you’re insulating for soundproofing alone, it might not qualify.

- New or Existing Property: While the scheme is primarily aimed at existing homes, there can be nuances for new builds or extensions, so it’s worth double-checking if your project falls into a specific category.

Benefits Of Insulating Floors During Restoration

Beyond the potential VAT savings, insulating your floors during a restoration offers some pretty solid advantages. For starters, it makes your home much warmer and more comfortable. You know those chilly drafts that seem to come from nowhere? Insulating the floor can really cut down on those. Plus, a warmer home means you’ll likely turn down your thermostat, which directly translates to lower energy bills. It’s a win-win, really.

Think about these benefits:

- Reduced Heat Loss: This is the big one. Floors can account for a significant amount of heat loss in a home, especially older ones.

- Improved Comfort: Say goodbye to cold feet and drafts. Your living spaces will feel much more pleasant.

- Lower Energy Bills: Less heat escaping means your heating system doesn’t have to work as hard, saving you money.

- Environmental Impact: By using less energy, you’re also reducing your carbon footprint.

Assessing The Cost-Effectiveness Of Floor Insulation

When you’re weighing up the costs, it’s easy to get bogged down in the numbers. But remember to factor in the 0% VAT rate if your project qualifies. This can make a noticeable difference to the overall price.

Here’s a simplified way to think about it:

| Cost Component | Typical Cost (Example) | VAT Rate | Cost After VAT | Potential Saving (0% VAT) |

|---|---|---|---|---|

| Materials (Insulation) | £1,000 | 20% | £1,200 | £200 |

| Labour (Installation) | £1,500 | 20% | £1,800 | £300 |

| Total Project | £2,500 | 20% | £3,000 | £500 |

This table is just an illustration, of course. Your actual costs will depend on the size of your home, the type of flooring, and the specific insulation product you choose. But even with this basic example, you can see how a 0% VAT rate can shave a good chunk off the final bill. When you combine this with the long-term savings on your energy bills, the investment in floor insulation during your restoration often pays for itself over time.

Navigating The VAT On Floor Insulation UK Regulations

So, you’re looking to insulate your floors during a restoration and want to take advantage of that 0% VAT rate. That’s smart thinking! But like anything involving taxes and regulations, there are a few things you need to get right. It’s not just a case of slapping some insulation down and expecting the discount to appear. Let’s break down what you need to know to make sure you’re on the right side of HMRC.

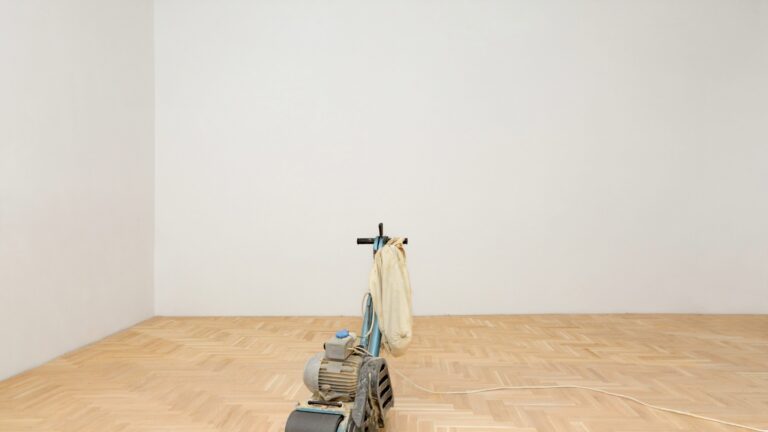

Identifying Approved Installers For VAT Purposes

This is a big one. The reduced VAT rate generally applies when the work is carried out by a VAT-registered installer. This isn’t just any builder; they need to be registered with HMRC for VAT. Why? Because they’re the ones who will be issuing the invoice correctly, showing the reduced VAT rate. If you hire someone who isn’t VAT registered, or who doesn’t charge VAT correctly, you won’t be able to claim the 0% rate. It’s worth checking their credentials. You can usually find this information on their website or by asking them directly. Make sure the installer understands the 0% VAT rules for energy-saving materials. They should be experienced in this area.

Documentation Needed To Claim Reduced VAT

When the work is done, you’ll need proof. The main document is the invoice from your installer. This invoice needs to be detailed. It should clearly state:

- The name and address of the installer.

- Your name and address.

- A description of the work done (e.g., ‘installation of floor insulation’).

- The total cost of the materials and labour.

- Confirmation that the 0% VAT rate applies.

Sometimes, the installer might also ask you to sign a declaration confirming that the property is your private residence and that the work is for energy-saving purposes. Keep all these documents safe. You might need them if HMRC ever asks for proof of your claim.

Common Pitfalls When Claiming VAT Relief

People often trip up in a few key areas. One common mistake is assuming all materials automatically qualify. For floor insulation, it’s usually the insulation materials themselves and the labour to install them that get the reduced rate. If you buy materials yourself from a DIY store and then hire someone just to fit them, you’ll likely pay the standard VAT rate on the materials. Another pitfall is timing. The 0% rate applies to work done on or after April 1st, 2026. If you have work done before that date, the old rules apply. Also, be wary of installers who aren’t clear about the VAT. If they seem unsure or try to charge you the standard rate without a good reason, it’s a red flag. Always get a clear, itemised quote and invoice. Finally, remember this relief is for private homes. If you’re insulating a commercial property, different rules apply.

Maximising Savings On Your Insulation Project

So, you’re looking to insulate your floors during a restoration and want to make sure you’re getting the best deal, especially with that 0% VAT rate. It’s smart thinking! Beyond just the VAT reduction, there are a few other ways to really boost your savings and make this project pay off in the long run.

Combining VAT Relief With Other Grants

Don’t stop at the VAT! While the 0% rate is a big win, there might be other government schemes or local grants available to help with insulation costs. These can sometimes be stacked with the VAT relief, meaning you could save even more. It’s worth doing a bit of digging on the government’s Energy Saving Trust website or checking with your local council. They often have lists of available funding for homeowners looking to improve their property’s energy efficiency. Finding these extra bits of funding can significantly cut down your upfront costs.

Planning Your Restoration For Optimal Insulation

If you’re already deep into a restoration, think about how insulation fits into the bigger picture. Can you coordinate the floor insulation with other work, like underfloor heating installation or plumbing upgrades? Doing it all at once can save on labor costs, as tradespeople might charge less if they’re already on-site for multiple jobs. Also, consider the type of insulation. Some materials are easier to install when the floors are already open, potentially reducing fitting time and therefore cost. It’s about being strategic and looking at the whole project, not just one part.

Long-Term Financial Advantages Of Floor Insulation

Let’s talk about the payoff. Insulating your floors isn’t just about saving money on the initial installation through VAT relief and grants. The real win comes over time. You’ll notice a difference in your heating bills pretty quickly – less heat will escape through the floor, meaning your boiler won’t have to work as hard. This not only saves you money month after month but also reduces wear and tear on your heating system. Plus, a warmer, more comfortable home is just a nicer place to live, right? Over the years, these savings add up, making the initial investment well worth it. It’s a solid move for your wallet and for the planet.

The Future Of Energy Efficiency And VAT

Anticipated Changes To Energy Saving VAT Policies

So, what’s next for VAT on energy-saving stuff? It’s a bit of a moving target, honestly. The government keeps an eye on how well these policies are working, and they might tweak things. We could see the 0% VAT rate continue, or maybe it shifts to a lower, but not zero, rate down the line. It really depends on the broader economic picture and how much pressure there is to meet climate targets. Keep an eye on official announcements from HMRC; that’s where the real info will be.

The Role Of Insulation In Meeting Climate Goals

Insulation, like the floor insulation we’ve been talking about, plays a pretty big part in the UK’s plan to cut down on carbon emissions. When your home is better insulated, you need less energy for heating. Less energy used means fewer greenhouse gases going into the atmosphere. It’s a straightforward connection, really. Making homes more energy-efficient is one of the most practical ways individuals can contribute to the UK’s climate targets.

Preparing For Future Regulatory Shifts

Thinking ahead is always a good idea. While the 0% VAT rate is a nice perk right now, it’s wise to plan your restoration projects with the possibility of changes in mind.

- Stay Informed: Regularly check government websites and reputable home improvement resources for updates on VAT rules and any new grants or schemes.

- Budget Wisely: Factor in potential VAT increases into your long-term renovation budget. It’s better to be prepared than surprised.

- Prioritise Efficiency: Even if VAT rates change, the long-term savings from good insulation remain. Focus on the overall energy efficiency benefits.

By keeping these points in mind, you can make sure your restoration project stays on track, regardless of what happens with future VAT policies.

Thinking about how to make your home more energy-efficient and what that means for taxes? It’s a big topic, but understanding the basics can save you money and help the planet. We’ve broken down the key ideas to make it easy to grasp. Want to learn more about saving energy and potential tax benefits? Visit our website today for all the details!

So, What’s the Bottom Line?

Alright, so we’ve talked a lot about this 0% VAT thing for energy-saving stuff, and specifically, floor insulation during your home restoration. It sounds pretty good, right? Getting that discount can really make a difference in your budget, especially with all the costs that come with renovating. But, and there’s always a ‘but’, you’ve got to make sure you fit the rules. It’s not just a free-for-all. Check with the official sources, maybe even your builder or a tax person, just to be absolutely sure you qualify before you get your hopes up too high. If you do, though? That’s a nice chunk of change saved that you can put towards other parts of your project. Good luck with the work!

Frequently Asked Questions

So, what’s the deal with the 0% VAT on saving energy stuff?

Basically, the government wants to help folks make their homes more energy-efficient. So, for certain energy-saving improvements, like adding insulation, you don’t have to pay the usual Value Added Tax (VAT). It’s like a discount to encourage people to go green and save on their bills!

Does putting insulation in my floors during a remodel count for this 0% VAT?

Most likely, yes! If you’re doing work on your home and decide to insulate your floors, it usually falls under the energy-saving measures that get the 0% VAT treatment. It’s a great time to do it while you’re already fixing things up.

Are there special rules for floor insulation to get the tax break?

Yep, there are a few things to keep in mind. The insulation needs to meet certain standards, and usually, you’ll need a certified professional to do the work. It’s all about making sure the job is done right and actually helps save energy.

How do I make sure I get the 0% VAT when I pay for my floor insulation?

The trick is to hire an installer who knows about the 0% VAT rules. They’ll usually sort out the paperwork for you. Make sure you get a proper invoice that shows the reduced VAT rate. Keep good records, just in case!

Can I combine this VAT saving with other money-saving offers for insulation?

That’s a smart question! Often, you can. You might be able to use the 0% VAT deal along with government grants or other local schemes that help pay for insulation. It’s definitely worth looking into all the options to save as much as possible.

What if I’m not sure if my home improvement project qualifies for the 0% VAT?

No worries! The best thing to do is chat with the company doing the work, like your insulation installer. They should be able to tell you if your specific situation qualifies for the reduced VAT. You can also check the official government website for the latest details.