Thinking about fixing up your wooden floors to make your home easier for someone with a disability to get around? You might be wondering about the tax side of things, especially with changes coming up. This guide is here to help you figure out if your project qualifies for VAT relief in the UK, focusing on what you need to know for 2026. We’ll break down what counts as ‘disabled access’ and how it relates to your flooring work. It’s not always straightforward, but getting it right could save you some money.

Key Takeaways

- VAT relief for disabled access flooring in the UK is available for specific modifications, not general repairs.

- Making your home accessible for someone with a disability is the main goal for qualifying for this relief.

- Wood floor restoration projects must focus on improving accessibility to be eligible for VAT savings.

- Changes are coming in 2026, so it’s important to stay updated on the rules for vat on floor restoration uk.

- Proper documentation and consulting with your contractor and HMRC are key steps to successfully claiming VAT relief.

Understanding VAT Relief for Disabled Access Flooring

So, you’re looking into getting your wood floors sorted out, maybe to make things a bit easier around the house for someone with a disability. That’s a great idea, and the good news is there’s a VAT relief that might help with the costs. But what exactly counts as ‘disabled access’ when we’re talking about floors, and who gets to take advantage of this relief? Let’s break it down.

What Does ‘Disabled Access’ Really Mean?

When we talk about disabled access in the context of your home, it’s not just about adding a ramp. It’s about making modifications that help someone with a disability move around more freely and safely. For flooring, this often means creating a smoother, more even surface. Think about removing trip hazards like thick rugs or uneven thresholds. It could also involve widening doorways or ensuring there’s enough space for things like wheelchairs or walkers to get through easily. The main goal is to remove barriers that make daily living harder. It’s about practical changes that make a real difference.

Who Qualifies for VAT Relief on Floor Restoration?

This is the big question, right? Generally, VAT relief on building work for disabled access is available if the work is done to a private residence and is for the benefit of a person with a long-term disability. This doesn’t mean a temporary injury; it’s usually something that’s expected to last for at least three years. The person with the disability can be the homeowner, a tenant, or even a relative living there. The work needs to be specifically for the purpose of providing the disabled person with better access or facilities. It’s not for general home improvements.

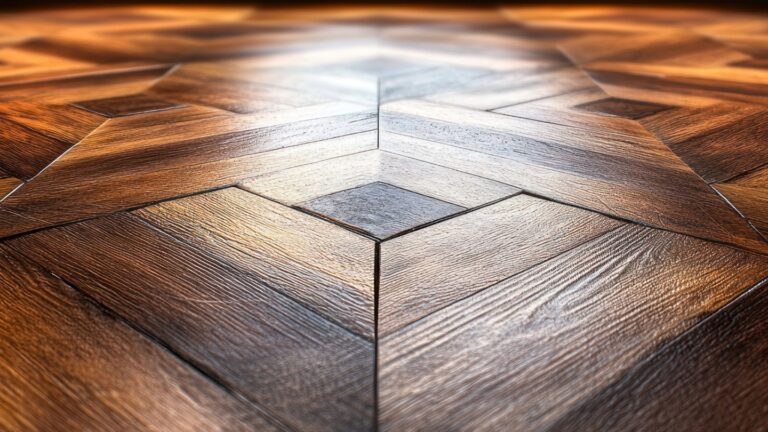

The Link Between Flooring and Accessibility

Flooring might seem like a small part of accessibility, but it’s actually pretty important. Old, uneven, or carpeted floors can be a real challenge for people with mobility issues. Imagine trying to push a wheelchair over a shaggy carpet or navigate a hallway with a raised edge. It’s tough! Making floors level, smooth, and easy to move across directly impacts how someone can get around their own home. For wood floors, this could mean sanding down uneven boards, replacing damaged sections, or even laying a new, smoother wood surface. It’s all about creating a safe and usable space.

Sometimes, the simplest changes make the biggest impact. Don’t underestimate how much a well-maintained, accessible floor can improve someone’s quality of life at home.

Is Your Wood Floor Restoration Eligible for VAT Savings?

So, you’re thinking about fixing up those old wood floors, maybe to make things a bit easier around the house for someone with mobility issues. That’s great! But does the work actually qualify for that VAT relief we’ve been hearing about? It’s not always a straightforward yes or no. The taxman, HMRC, has specific ideas about what counts.

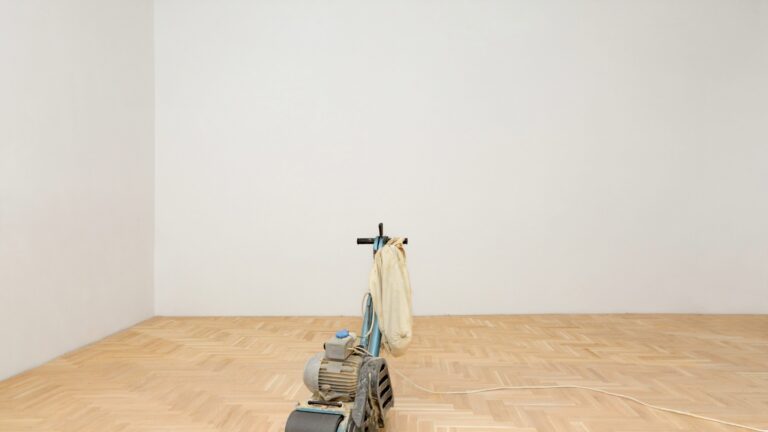

Focusing on Essential Modifications

Look, if you’re just sanding down your floors because they look a bit scuffed or you want a new finish, that’s probably not going to get you VAT relief. The key here is accessibility. The work needs to be directly related to making the home easier to use for a disabled person. Think about things like:

- Removing trip hazards like uneven thresholds.

- Creating smoother, level transitions between rooms.

- Widening doorways if the floor work is part of that larger project.

The modifications must be specifically for the disabled person’s needs. It’s not about general home improvement; it’s about practical changes that help someone get around their home more safely and easily.

When Standard Repairs Don’t Cut It

This is where it gets a bit tricky. If your floor is just worn out and you’re replacing it with something similar, that’s usually a standard repair. VAT relief isn’t for just making things look nice or replacing old for old. It’s for adaptations. For example, if you have a very uneven floor that’s a real hazard, and you need to level it out significantly or install a specific type of subfloor to accommodate a ramp, that’s more likely to qualify. But if you’re just replacing rotten floorboards in a small area without any accessibility goal in mind, don’t expect the VAT to disappear.

The main thing to remember is that the work has to be a direct result of the disability and aimed at improving access or safety within the home. It’s not about the aesthetic appeal of the wood floor itself, but how its condition or modification impacts the disabled person’s ability to live comfortably and safely.

The Importance of Professional Assessment

Honestly, trying to figure this out on your own can be a headache. It’s really worth getting a professional opinion. Your flooring contractor, especially one who has experience with accessible home modifications, can be a huge help. They’ll know what kind of work typically gets approved and what doesn’t. They can also help you document the project correctly, which is super important when you’re dealing with HMRC. Sometimes, a simple conversation with the right person can save you a lot of confusion and potential trouble down the line. They can help you understand if your specific project aligns with the rules for VAT relief.

Navigating the VAT on Floor Restoration UK Landscape

Okay, so let’s talk about the nitty-gritty of VAT when you’re looking at getting your wood floors sorted for better accessibility. It can feel a bit like a maze sometimes, right? Especially with changes coming up. Understanding the rules now is key to saving money later.

Key Changes to Expect in 2026

Things are shifting a bit in 2026, so it’s good to be aware. While the core idea of VAT relief for disabled access remains, the specifics can get tweaked. HMRC (that’s Her Majesty’s Revenue and Customs, the tax folks) sometimes updates their guidance. It’s not usually a massive overhaul, but small adjustments can happen. Think about it like a software update – mostly the same, but with a few new features or fixes.

Common Pitfalls to Avoid with VAT Claims

People often trip up on a few things when they’re trying to claim VAT relief. It’s easy to do if you’re not paying close attention.

- Getting the paperwork wrong: This is a big one. If your forms aren’t filled out correctly, or you miss a crucial piece of info, your claim could get rejected.

- Claiming for work that isn’t eligible: Not all floor work qualifies. If you’re just redecorating or doing a standard repair that doesn’t directly help with disabled access, you probably can’t claim VAT relief on it.

- Not getting a proper quote: Your contractor needs to be clear about what’s eligible for VAT relief and what isn’t. A vague quote can cause problems down the line.

- Forgetting to get the right declaration: You’ll usually need a signed declaration from the person the work is for, stating they’re disabled.

Getting Your Documentation Right

This is where you really need to be on the ball. Having your ducks in a row makes the whole process smoother. You’ll want to keep records of:

- Invoices: Make sure they clearly show the cost of the eligible work and the VAT amount.

- Quotes: Keep these handy, especially if they detail the specific modifications for accessibility.

- HMRC forms: The relevant VAT relief claim forms need to be completed accurately. You can usually find these on the GOV.UK website.

- Proof of disability: This might be a letter from a doctor or a relevant benefit award letter, depending on what HMRC requires.

The main thing to remember is that the work must be specifically for the purpose of providing better access for a disabled person. It’s not just about making your home look nicer; it’s about making it more functional for someone with mobility issues. If the work would have been done anyway as a standard repair or improvement, it likely won’t qualify.

It might seem like a lot, but taking the time to understand these points now will save you headaches and money when you’re ready to get your floors done.

Making Your Home More Accessible with Floor Upgrades

Ramps, Level Access, and Your Floors

When we talk about making a home easier to get around, especially for folks with mobility challenges, the floors are a big deal. Think about it: a tricky step or a thick rug can be a real barrier. For wood floors, this often means looking at how to create smoother transitions. This could involve installing small, low-profile ramps right over existing flooring or, in more involved renovations, ensuring new floor levels are flush. The goal is to get rid of those sudden drops or rises that can make moving around difficult. It’s all about creating a clear, unobstructed path.

Choosing the Right Flooring Materials

If you’re thinking about new flooring or modifying what you have, material choice matters. For accessibility, you want something that’s not too slippery when wet and doesn’t have a lot of texture that could catch a walker or wheelchair. While we’re focusing on wood floors here, remember that even within wood, finishes can make a difference. A matte finish is generally less slippery than a high-gloss one. If you’re considering other materials alongside wood, look for options with a good grip. Sometimes, a thin, durable overlay might be a good option to smooth out an existing wood floor and make it more accessible.

The Long-Term Benefits of Accessible Homes

Making your home more accessible isn’t just about ticking boxes; it has real, lasting perks. For the person needing better access, it means more independence and less worry about getting around their own space. For families, it means everyone can share the home more comfortably. Plus, when you make these upgrades thoughtfully, especially with an eye on potential VAT relief, you’re not just improving daily life now, you’re also adding to the home’s value and future-proofing it. It’s an investment in comfort, safety, and peace of mind for years to come.

Think of your floors as the foundation for movement within your home. When they’re easy to traverse, everything else becomes simpler. This applies whether you’re using a wheelchair, a walker, or just want to avoid tripping hazards.

Securing Your VAT Relief: A Step-by-Step Approach

Alright, so you’ve figured out that your wood floor project might qualify for some VAT savings. That’s awesome! But how do you actually get that relief? It’s not just a matter of hoping for the best. You’ve got to follow a few steps to make sure HMRC is happy and you get your discount. Getting this right means you save money and make your home more accessible.

Consulting with Your Contractor

First things first, have a good chat with the people doing the work. Your contractor is your best friend here. They should know about VAT rules for building work, especially for disabled access. Ask them directly if they’ve handled VAT relief claims before. They can help you figure out if your specific job fits the bill and what paperwork they’ll need from you. If they seem unsure, maybe it’s time to find someone who knows more about this stuff. It’s better to be upfront about it from the start.

Understanding the HMRC Guidelines

HMRC (that’s Her Majesty’s Revenue and Customs, the UK tax folks) has specific rules about this. They want to make sure the relief is only given for work that genuinely helps someone with a disability. This usually means the work has to be necessary for providing that access. Think about things like making doorways wider, installing ramps, or, in our case, making sure the floor itself is safe and easy to move over. Standard upgrades or just making things look pretty usually don’t count. You can find the official details on the HMRC website, but it can be a bit dense. That’s why talking to your contractor or a tax advisor is a good idea.

Applying for VAT Relief on Your Project

So, how does the actual saving happen? Usually, your contractor will charge you the reduced VAT rate (or zero rate, if applicable) directly on their invoice. This means you don’t pay the full VAT upfront and then try to claim it back later, which is a whole other headache. You’ll likely need to give your contractor a declaration form, confirming that the work is for disabled persons and meets the eligibility criteria. They’ll keep this on file.

Here’s a general idea of what the process looks like:

- Initial Discussion: Talk to your contractor about your needs and the VAT relief possibility.

- Assessment: The contractor (or you, with their help) checks if the work meets HMRC’s disabled access criteria.

- Declaration: You fill out and sign a declaration form provided by the contractor.

- Invoicing: The contractor invoices you with the correct, reduced VAT rate.

- Record Keeping: Keep all invoices and documentation safe, just in case HMRC asks for them later.

It’s really important to be honest and accurate on any forms you fill out. Misrepresenting the work could lead to penalties. Stick to the facts about why the flooring work is needed for accessibility.

Sometimes, if the work is more complex or you’re unsure, you might need to get a letter from a medical professional or an occupational therapist confirming the need for the adaptations. Your contractor should guide you on this. It’s all about proving the work is directly related to overcoming a disability barrier.

Ready to make sure you’re getting all the VAT relief you deserve? Our guide, “Securing Your VAT Relief: A Step-by-Step Approach,” breaks down exactly what you need to do. Don’t miss out on potential savings! Visit our website today to learn more and get started.

Wrapping It Up

So, that’s the lowdown on getting VAT relief for wood floor work when you need better access for a disability. It’s not super complicated, but you do need to get the paperwork right. Make sure you chat with whoever’s doing the work and the tax folks if you’re unsure about anything. Getting your home set up just right can make a big difference, and it’s good to know there are ways to save a bit of cash while you do it. Hope this helps you out!

Frequently Asked Questions

What exactly counts as ‘disabled access’ for this VAT relief thing?

Basically, it means making changes to your home so someone with a disability can get around more easily and safely. This could be things like making sure a wheelchair can roll smoothly, or removing tripping hazards. It’s all about making your living space more usable for everyone.

Can I get this VAT relief if I’m just fixing up my old wood floors?

It’s not just for any old repair. The key is that the work you’re doing must be specifically to improve disabled access. So, if you’re fixing the floor to help someone move around better, like making it level or smoother, then yes, it might count. Just regular fixing usually doesn’t qualify.

Who is actually allowed to get this VAT discount?

You can usually get this relief if you’re disabled yourself, or if you’re doing the work for a family member who is disabled and lives with you. The government wants to help make homes more accessible for people who need it.

What if I’m not sure if my floor project is eligible? What should I do?

It’s always a good idea to talk to the people doing the work, like your flooring contractor. They usually know the rules pretty well. You can also check the official government website (HMRC) for the latest details, or even ask them directly if you’re still unsure. Getting it right from the start saves headaches later!

Are there any big changes coming in 2026 for this VAT relief?

Yes, there are some updates happening in 2026. The rules might get a bit more specific about what kind of work qualifies. It’s important to stay updated on these changes, as they could affect whether your project is eligible for the savings.

What kind of paperwork do I need to keep for my VAT relief claim?

You’ll need to have good records! This usually means getting a detailed invoice from your contractor that clearly shows the work done and how it relates to disabled access. Keep everything organised, as you might need to show it to prove your claim.