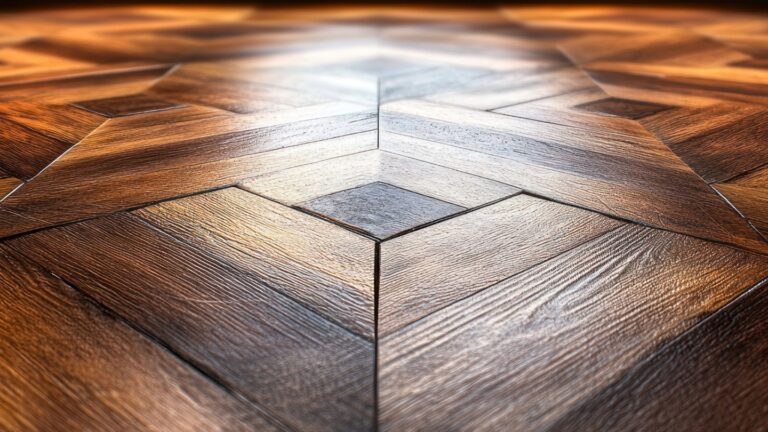

Is your wood floor insurance claim process causing you more headaches than solutions? Navigating the intricacies of wood floor insurance can feel like walking on thin ice, especially when immediate action and precise documentation are essential. This guide unravels the complexities of insurance documentation, providing actionable tips to ensure your claims are processed swiftly and effectively. With insights from Ryan’s Restoration, you’ll discover how professional documentation not only safeguards your investment but also paves the way for successful claims, ultimately preserving the aesthetic and value of your home.

Understanding Wood Floor Insurance Claims

Insurance claims for wood floors often cover damages resulting from sudden and accidental incidents. These can include scenarios such as burst pipes that unexpectedly flood an area or storm-related damage where water leaks through the roof onto the floors. Other covered damages might involve accidental appliance overflows or plumbing mishaps leading to water intrusion. It’s crucial for policyholders to review their home insurance policies, as coverage specifics can vary significantly. Understanding these details helps ensure that claims are accurate and comprehensive, reducing the likelihood of denial due to misinterpretation of policy terms.

Common causes of wood floor damage include:

- Burst pipes

- Roof leaks

- Plumbing leaks

- Appliance overflows

- Open windows during rainstorms

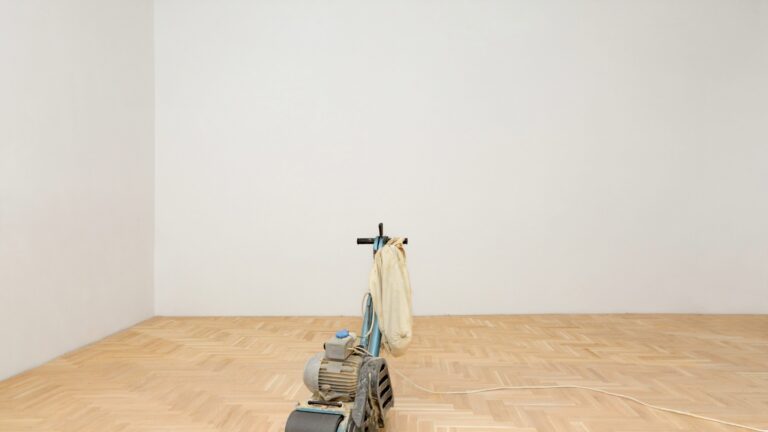

When assessing wood floor damage for an insurance claim, immediate action is vital. Initially, stopping the water source is a priority to prevent further damage. Once the situation is under control, documenting the damage becomes essential. Taking detailed photographs of the affected areas and creating a descriptive log of the incident can significantly aid in the claims process. This documentation not only strengthens the claim but also provides a clear record for adjusters to assess the extent of the damage. Properly collecting and organising this information is a key step in ensuring a smooth and successful insurance claim process.

Documenting Damage: A Professional’s Approach

Effective documentation is crucial in ensuring a successful wood floor insurance claim. Why is detailed documentation important? The precision of your evidence can significantly impact the outcome of your claim. Insurers rely heavily on the quality of documentation to assess the extent and validity of the damage. Therefore, capturing comprehensive photographic evidence is a priority. Images should clearly show the damaged areas from multiple angles, providing a visual narrative of the incident. Additionally, maintaining accurate records such as damage logs and repair receipts further strengthens your claim. These documents serve as tangible proof of the damage and any corrective actions taken, making it easier for the adjusters to evaluate the situation accurately.

Essential items to document include:

- Photographic evidence from multiple angles

- Detailed damage logs

- Repair receipts

- Inspection reports

- Correspondence with professionals

- Insurance policy details

Compiling evidence effectively requires a methodical approach. Begin by systematically organising all documentation into a cohesive file, ensuring each item is clearly labelled and dated. This not only facilitates easy retrieval during the claims process but also helps maintain a structured record for future reference. Professional damage inspection reports, as Ryan’s Restoration recommends, offer an authoritative assessment of the situation, lending credibility to your claim. Moreover, maintaining an open line of communication with restoration experts and your insurer can provide additional insights and guidance, further enhancing the robustness of your evidence collection.

Navigating the Claims Process

Filing a claim for wood floor damage requires precision and promptness. What are the initial steps in filing a claim? Notify your insurer immediately. Quick action is essential to ensure that any further damage is minimised and the claim process begins without delay. Gather all relevant documentation, which includes photographs, damage logs, and any repair estimates. This evidence is crucial for substantiating your claim. Once you have notified the insurer, they will guide you through their specific claim filing procedures, which may vary depending on the policy and provider.

Interacting with insurance adjusters is a critical component of the claims process. How can you effectively engage with the adjuster? Approach discussions with transparency and preparedness. Understanding the extent of your wood floor damage and having organised documentation readily available can positively influence the outcome. Adjusters assess the credibility of the claim based on the provided evidence and may request additional information or conduct an in-person inspection. Being cooperative and responsive to these requests ensures a smoother evaluation process. Furthermore, obtaining repair estimates from reputable contractors can provide a benchmark for negotiations, aligning expectations for repair costs. Ryan’s Restoration offers expert consultations, assisting in the preparation and presentation of claims, which can be invaluable during this stage.

Avoiding Common Pitfalls in Insurance Claims

Why do insurance claims often get denied? Incomplete documentation and misunderstanding policy terms are the primary culprits. Precision in documentation is non-negotiable; insurers need thorough evidence to validate claims. Overlooking policy specifics can also lead to denial, as each insurance policy has unique coverages and exclusions. Ensuring clarity in both the documentation and understanding of policy details is essential to prevent unnecessary setbacks.

Strategies to ensure claim approval include:

- Accurate Documentation: Capture all details with clear photographs and detailed logs.

- Understand Policy Terms: Familiarise yourself with every aspect of your insurance policy.

- Timely Reporting: Report the damage to your insurer promptly to avoid complications.

- Professional Assessments: Obtain expert evaluations to substantiate your claim.

- Consistent Follow-Up: Maintain regular communication with your insurer and adjuster.

What should you do if your claim is denied? The appeal process can be your next step. Review the denial letter carefully to understand the reasons behind the rejection. Ryan’s Restoration suggests compiling additional evidence or clarifications that address the insurer’s concerns. Engage in dialogue with your insurer, presenting the new information and making a compelling case for reconsideration. Their expertise can guide you through this process, increasing the likelihood of a successful appeal by ensuring all necessary adjustments to your documentation and approach are made.

Case Studies and Professional Testimonials

Real-world case studies provide valuable insights into the effectiveness of comprehensive documentation in wood floor insurance claims. How can case studies demonstrate successful claims? By showcasing scenarios where meticulous documentation led to favourable outcomes, these examples underline the importance of precision and thoroughness in the claims process. For instance, a case involving a burst pipe illustrates how detailed photographic evidence and repair receipts facilitated a swift settlement. Another example shows how a homeowner’s proactive approach in obtaining expert reports and damage logs resulted in a successful claim despite initial insurer reluctance. These case studies highlight the critical role of structured documentation in navigating complex claims efficiently.

Key learnings from the case studies include:

- The importance of comprehensive photographic documentation.

- The value of expert assessments in strengthening claims.

- The effectiveness of maintaining detailed damage logs.

Testimonials from Ryan’s Restoration clients further emphasise the significance of expert guidance and strategic documentation. Clients have praised the company’s ability to provide clear and actionable advice, which significantly enhances the claims process. One client noted how Ryan’s Restoration’s partnership helped streamline communication with insurers, ensuring all documentation was presented effectively. Another testimonial highlights how expert reports from the company provided the necessary authority to substantiate claims, leading to successful settlements. These endorsements underscore the importance of collaborating with experienced professionals to optimise the documentation strategy and enhance the likelihood of claim approval.

Final Words

Efficiently navigating wood floor insurance claims requires a comprehensive understanding of potential damages, the documentation needed, and the claims process. Recognising common pitfalls, as well as employing professional documentation strategies, are key to successful claims. Ryan’s Restoration exemplifies how expert guidance can streamline this process, offering detailed insights and real-world testimonials. Utilising the resources and knowledge provided in Wood Floor Insurance Claims: A Professional’s Guide to Documentation empowers individuals to confidently manage claims. With informed actions and expert support, achieving a fair settlement for wood floor damages becomes a realistic and attainable outcome.

FAQ

Is wooden flooring covered by contents insurance?

Typically, wooden flooring is considered part of the building structure, not contents insurance. Review the policy to confirm coverage specifics regarding permanent fixtures like wood floors.

What are the five steps to file a claim?

Filing a claim generally involves notifying the insurer, documenting damage, submitting required forms, interacting with an adjuster, and negotiating settlements. Consult the insurance provider for a detailed procedure.

What do insurance companies check when you make a claim?

Insurance companies evaluate documentation, assess the cause of damage, check for compliance with policy terms, and may send an adjuster for further inspection. Thorough evidence supports successful claims.

Can you claim house insurance for flooring?

House insurance usually covers flooring if damaged by insured events like leaks or water damage. Verify specific situations covered in the policy to understand eligibility for wood floor claims.